Pexapark says record number of European power purchase agreements in 2023

namkoo solar

namkoo solar

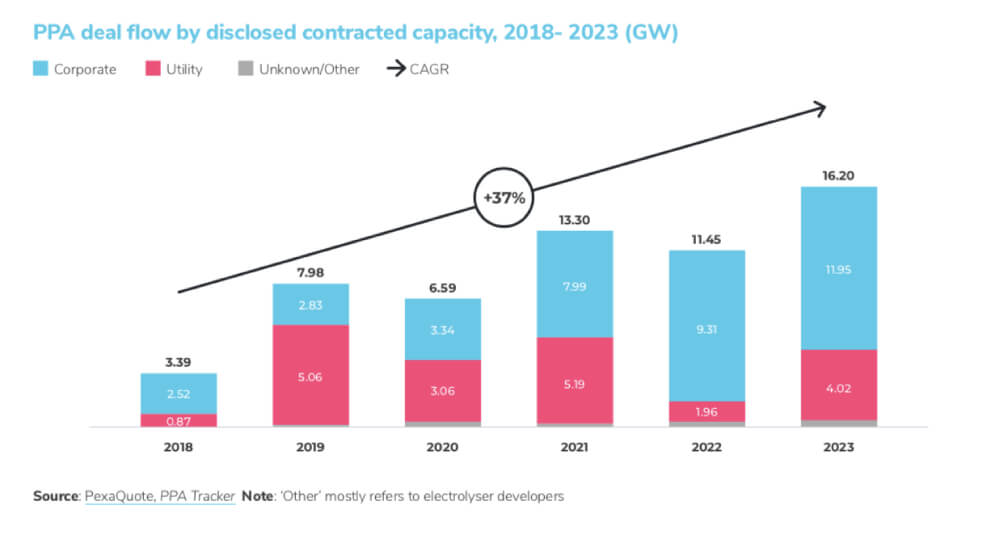

The European market for power purchase agreements (PPAs) reached 16.2 GW of contracted capacity in 2023, up 40% year-on-year.

Swiss consultancy Pexapark said the results mark a "golden age" for the European PPA market, which it predicts will exceed 20 GW by 2024.

In 2023, the European PPA market broke the original record in terms of both the number of agreements signed and the contracted capacity.

According to a report by Swiss consultancy Pexapark, the disclosed contract signing capacity was 16.2 GW in 2023, up 40% from the previous year.The total number of PPA deal announcements reached a whopping 272, up 65% from 2022.

Solar PPAs totaled four times the amount of onshore and offshore wind, accounting for 10.5 GW of the 160 deals.

Pexapark said companies have played a significant role in driving the power purchase agreement market, securing 11.95 GW of capacity in 218 deals, up 28% year-on-year, with the number of deals up 66% year-on-year.

Utilities also saw significant growth, securing 4.02 GW in 48 deals, more than double the 1.96 GW in 2022 and a 60% increase compared to 30 deals last year.Pexapark said utilities are evolving to meet the challenges posed by price volatility, intermittent energy sources and higher green standards, among others.

Spain led the PPA market for the fifth consecutive year with 4.67 GW of total deals. Germany followed with a total volume of 3.73 GW. the two countries together accounted for 50% of the total volume traded for the year.

Italy (1.06 GW), the UK (0.96 GW), and Greece (0.95 GW) rounded out the top five. Looking ahead, Germany is expected to challenge Spain as the most active PPA market by 2024.

With reduced market volatility, a relatively stable pricing environment, and increasing sophistication of buyers and sellers in managing energy risks, the consultancy expects the PPA market to exceed 20 GW of contracted capacity by 2024.

Pexapark expects new developments in hybrid power purchase agreements (PPAs), 24/7 green procurement pathways, green hydrogen generation PPAs and multi-buyer PPAs to attract further attention in 2024.

The agency warned that competition between the contract for difference (cfd) and power purchase agreement markets, could become a new challenge, and said the introduction of a new government credit guarantee scheme could expand the number of potential offtakers entering the market.

"One of the key trends we are seeing is the evolving role of utilities in the marketplace to provide solutions to the challenges posed by price volatility, energy intermittency and higher green standards," said Luca Pedretti, co-founder and COO of Pexapark. "Project owners, utilities and corporations are joining forces to leverage each other's strengths to further enhance the role of structured power purchase agreements. Risk management firms such as utilities have the opportunity to further evolve into 'market integrators' and thus unleash significant innovative power in the marketplace."